Enhance Your Building: Know-how in Trust Foundations

Enhance Your Building: Know-how in Trust Foundations

Blog Article

Reinforce Your Heritage With Professional Depend On Structure Solutions

In the realm of legacy planning, the value of developing a solid foundation can not be overemphasized. Specialist trust foundation options supply a durable framework that can protect your possessions and guarantee your dreams are performed exactly as meant. From lessening tax obligation liabilities to selecting a trustee who can effectively handle your affairs, there are essential factors to consider that require interest. The complexities included in depend on structures necessitate a strategic approach that lines up with your long-lasting goals and values (trust foundations). As we dig into the nuances of count on foundation services, we uncover the crucial elements that can fortify your legacy and give a lasting impact for generations to come.

Benefits of Count On Foundation Solutions

Trust fund structure services offer a durable structure for securing assets and ensuring long-term economic safety and security for individuals and organizations alike. Among the primary benefits of depend on foundation remedies is property protection. By developing a depend on, individuals can secure their possessions from potential threats such as suits, creditors, or unforeseen monetary responsibilities. This protection makes certain that the possessions held within the count on continue to be safe and can be passed on to future generations according to the person's wishes.

With counts on, individuals can outline exactly how their properties need to be managed and dispersed upon their death. Depends on likewise use privacy benefits, as assets held within a count on are not subject to probate, which is a public and typically lengthy legal procedure.

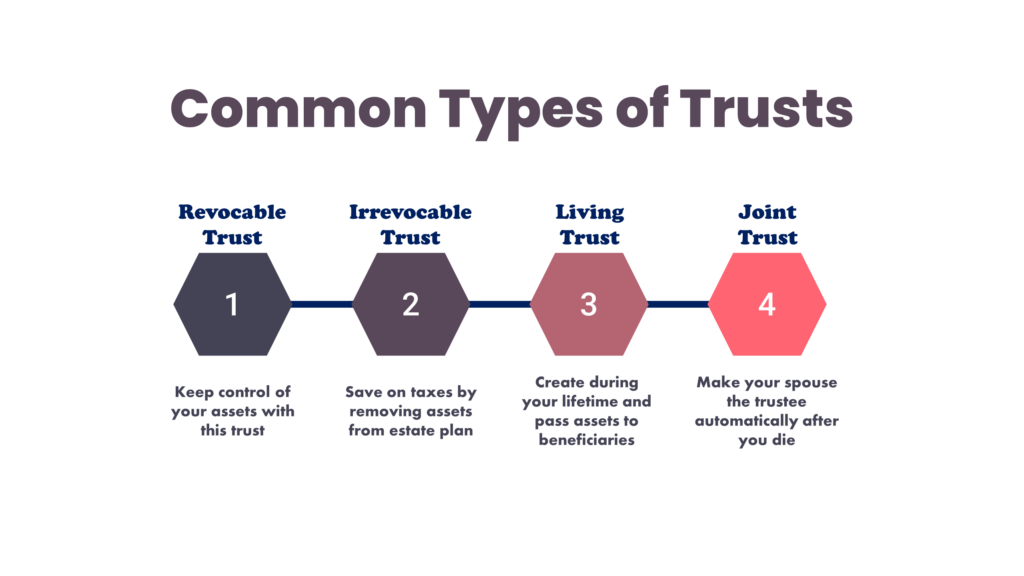

Kinds Of Trust Funds for Heritage Planning

When thinking about legacy planning, an essential aspect entails discovering different sorts of lawful tools developed to preserve and disperse possessions efficiently. One common kind of trust fund utilized in legacy preparation is a revocable living depend on. This count on allows individuals to maintain control over their assets throughout their lifetime while guaranteeing a smooth transition of these possessions to beneficiaries upon their passing away, preventing the probate procedure and supplying privacy to the family members.

Philanthropic counts on are additionally popular for individuals looking to sustain a reason while maintaining a stream of earnings for themselves or their recipients. Unique needs depends on are crucial for individuals with specials needs to guarantee they receive required treatment and support without threatening government benefits.

Comprehending the various kinds of trusts offered for tradition preparation is critical in developing an extensive method that straightens with specific objectives and top priorities.

Choosing the Right Trustee

In the realm of legacy preparation, a vital facet that demands careful consideration is the selection of a suitable individual to meet the essential function of trustee. Selecting the appropriate trustee is a decision that can substantially affect the successful execution of a trust and the fulfillment of the grantor's wishes. When selecting a trustee, it is vital to prioritize qualities such as trustworthiness, financial acumen, honesty, and a dedication to acting in the best interests of the beneficiaries.

Preferably, the chosen trustee must have a solid understanding of financial matters, be capable of making audio financial investment decisions, and have the capability to browse intricate lawful and tax demands. By very carefully taking into consideration these elements and choosing a trustee that straightens with the worths and objectives of the trust, you can assist make sure the lasting success and conservation of your legacy.

Tax Ramifications and Benefits

Taking into consideration the fiscal landscape surrounding count on structures and estate planning, it is vital to dive right into the detailed world of tax obligation implications and benefits - trust foundations. When establishing a trust, understanding the tax implications is important for enhancing the benefits and reducing prospective obligations. Counts on use different tax advantages depending on their structure and objective, such as lowering estate tax obligations, income taxes, and gift tax obligations

One substantial advantage of specific depend on structures is the ability to move properties to recipients with minimized tax consequences. Irrevocable depends on can get rid of properties from the grantor's estate, my blog potentially lowering her response estate tax obligation obligation. Additionally, some trusts enable earnings to be distributed to recipients, who might remain in lower tax obligation brackets, causing general tax financial savings for the household.

However, it is essential to note that tax obligation legislations are complex and subject to transform, emphasizing the need of speaking with tax obligation experts and estate preparation professionals to ensure conformity and optimize the tax advantages of count on structures. Properly browsing the tax ramifications of trusts can cause substantial cost savings and an extra efficient transfer of wide range to future generations.

Steps to Developing a Trust Fund

The first step in establishing a count on is to clearly define the function of the count on and the possessions that will be included. Next, it is important to choose the kind of depend on that finest lines up with your objectives, whether it be a revocable depend on, irreversible depend on, or living depend on.

Final Thought

Finally, developing a trust fund foundation can offer numerous advantages for heritage preparation, including property protection, control over circulation, and tax obligation benefits. By choosing the suitable sort of count on and trustee, people can secure their assets and guarantee their desires are accomplished according to their needs. Comprehending the tax effects and taking the needed steps to develop a count on can aid enhance your legacy for future generations.

Report this page